Pros and Cons of Higher Tariffs by Trump.

Here’s a breakdown of the pros and cons of higher tariffs proposed by Trump:

Pros of Higher Tariffs (Potential Benefits)

- Protection of Domestic Industries:

- Shielding U.S. Manufacturing: One of the primary reasons for imposing tariffs is to protect domestic industries from foreign competition. By making imported goods more expensive, tariffs give American manufacturers a price advantage, which can boost local production, support jobs in certain sectors (like steel, automotive, or textiles), and make it harder for foreign competitors to undercut U.S. prices.

- Encouraging Reshoring: Tariffs might encourage companies to bring manufacturing back to the U.S. (a process called reshoring). This could be beneficial for workers in sectors like manufacturing, electronics, and automobiles, especially in the Midwest and other areas hit hard by offshoring.

- Reduction of Trade Deficits:

- Improving Balance of Trade: Tariffs are sometimes seen as a tool to reduce a trade deficit—when a country imports more than it exports. By making foreign goods more expensive, tariffs can theoretically encourage consumers to buy domestically produced goods, potentially helping reduce the deficit.

- Boost to U.S. Exports: In theory, if a trading partner retaliates with tariffs on U.S. goods, the U.S. might push for trade agreements or open markets for its own exports. For example, if China imposes tariffs on U.S. goods, it could create an opening for U.S. businesses to explore other markets or force a renegotiation of trade terms.

- Encouraging Fairer Trade Practices:

- Addressing Unfair Trade: Tariffs can be a tool to force other countries to re-evaluate unfair trade practices, such as currency manipulation, subsidies for certain industries, or dumping (selling goods at below-market prices). By imposing tariffs, the U.S. may force trading partners like China or the European Union to address practices that harm American businesses.

- Political Leverage:

- Bargaining Chip in Trade Negotiations: Tariffs can be used as a bargaining tool in trade negotiations. The threat of tariffs—or actual imposition—can be leveraged to secure better terms in trade deals or to push foreign governments to make changes to their trade policies, intellectual property laws, or labor standards.

Cons of Higher Tariffs (Potential Drawbacks)

- Increased Costs for Consumers:

- Higher Prices: One of the immediate effects of tariffs is that they raise the cost of imported goods, which are often passed along to consumers. Products like electronics, clothing, automobiles, and food items could become more expensive, especially if the tariff is broad-based or affects popular imports.

- Reduced Purchasing Power: Higher prices reduce consumers’ purchasing power, leading to a potential decline in consumer spending. This could hurt industries dependent on consumer demand and reduce economic growth in the long term.

- Supply Chain Disruptions:

- Global Supply Chain Impact: Many U.S. companies rely on global supply chains—importing raw materials, components, or finished goods from countries with lower labor costs (e.g., China, Mexico, or Southeast Asia). Higher tariffs disrupt these global supply chains, increasing costs for manufacturers and potentially causing delays in production or shortages of goods.

- Increased Production Costs: Companies that depend on imported parts (for example, automakers, tech companies, or retailers) would face higher input costs, which could erode profits or be passed on to consumers in the form of higher prices. This is particularly a concern for electronics manufacturers, automakers, and other high-tech industries that rely on global sourcing.

- Job Losses in Certain Sectors:

- Retaliation and Export Markets: While some sectors may benefit from tariffs, others—particularly those that rely on exports—might suffer. For instance, agriculture (especially soybeans, pork, dairy, etc.) and aerospace are sensitive to trade disruptions. Countries that face U.S. tariffs might retaliate with their own tariffs on American goods, leading to a loss of export markets for U.S. businesses.

- Loss of Export-Dependent Jobs: Industries like agriculture, machinery, and automotive are heavily reliant on exports, and if foreign markets retaliate with tariffs, it could result in job losses in these sectors. For example, if China imposes tariffs on U.S. agricultural exports (as it did during the trade war), American farmers may face financial hardship.

- Global Trade Tensions and Retaliation:

- Trade Wars: Tariffs can escalate into a trade war, where countries retaliate with additional tariffs on each other’s goods. A prolonged trade war can hurt both economies, lead to supply chain chaos, and destabilize international markets. For example, during the U.S.-China trade war, both countries imposed tariffs on billions of dollars worth of goods, affecting a wide range of industries.

- Damage to Diplomatic Relations: Imposing tariffs can also strain diplomatic ties with key trading partners, potentially leading to long-term diplomatic and economic consequences beyond trade, especially if countries view the tariffs as protectionist or unfair.

- Impact on U.S. Firms Abroad:

- Higher Costs in Foreign Markets: U.S. companies operating abroad or with foreign subsidiaries may also face higher costs due to tariffs on goods and materials they need for production. For example, U.S. carmakers producing cars in Mexico for the U.S. market might find that tariffs on Mexican-made parts raise production costs, reducing the price competitiveness of U.S.-made cars.

- Global Competitive Disadvantage: If U.S. manufacturers face higher input costs due to tariffs, they may become less competitive compared to manufacturers in other countries that aren’t subject to the same tariffs. This could result in a decline in global market share for some American companies.

Summary: Will Higher Tariffs Be Good or Bad?

- Short-Term Impact: In the short term, higher tariffs might benefit domestic industries that are directly protected from foreign competition, especially manufacturing sectors that are vulnerable to cheaper imports. For example, the steel and aluminum industries might benefit, and there may be an increase in U.S. jobs in these sectors.

- Long-Term Impact: Over the long term, the economic effects are more mixed. While some domestic industries might thrive, the higher costs for consumers and businesses could reduce overall economic growth. If tariffs lead to retaliatory measures, it could hurt export-dependent industries and reduce international trade, leading to potential job losses and higher prices for consumers.

- Overall Effect: The impact of higher tariffs will largely depend on the balance between benefits to protected industries (like steel, solar, and certain manufacturing sectors) and the costs to consumers and other sectors (like agriculture, technology, and retail). A trade war could ultimately result in economic losses for both the U.S. and its trading partners.

In conclusion, higher tariffs are likely to be a double-edged sword: they could protect certain industries and reduce the trade deficit in the short run, but they risk escalating costs, reducing global competitiveness, and potentially harming overall economic growth in the long run. The net effect will depend on the specifics of the tariff policies, the response from trading partners, and the adaptability of U.S. businesses to new trade conditions.

How Trump’s Tariffs Could Impact your Wallet.

Tariff Quotes

- “The higher the tariff, the more likely it is that the company will come into the United States, and build a factory in the United States so it doesn’t have to pay the tariff.” ~Donald Trump

- “If we get tariffs, we will pass those tariff costs back to the consumer,” ~Philip Daniele, CEO of AutoZone.

- “We try to prevent the creation of artificial rents. Rather than setting up quotas to stop imports we levy a tariff, that would be better. Or we pay wages in the public sector which are roughly equivalent to the productivity in the private sector and we don’t therefore make it a special benefit to get a bureaucratic position.” ~James M. Buchanan

- “You see these empty, old, beautiful steel mills and factories that are empty and falling down. We’re going to bring the companies back. We’re going to lower taxes for companies that are going to make their products in the USA. And we’re going to protect those companies with strong tariffs.” ~Donald Trump

- “As we learned after President Herbert Hoover signed the Smoot-Hawley tariff at the outset of the Great Depression, vibrant international trade is a key component to economic recovery; hindering trade is a recipe for disaster.” ~Asa Hutchinson

- “I feel pretty confident saying [tariffs] are a price-raising policy. The question is just the magnitude.” ~Mike Pugliese

- “It’s so hard to get our goods into China. And when we do get in they charge us a huge surtax. They call it a surtax or a tariff. I call it a tax.” ~Donald Trump

Supply Chain Resources

- Best Trade War and Tariff Quotes.

- Continuous Improvement for the Home: Top 10 Ways to Save Money.

- End To End SCM Process

- Guide to Supply Chain Management.

- Recession Quotes by Top Minds.

- SCM Resources by Topic & Supplier.

- Supply Chain Strategies to Mitigate Tariff Risks.

- Why The American Dream Became Unaffordable For The Middle Class.

- 10 Strategies to Mitigate Tariffs.

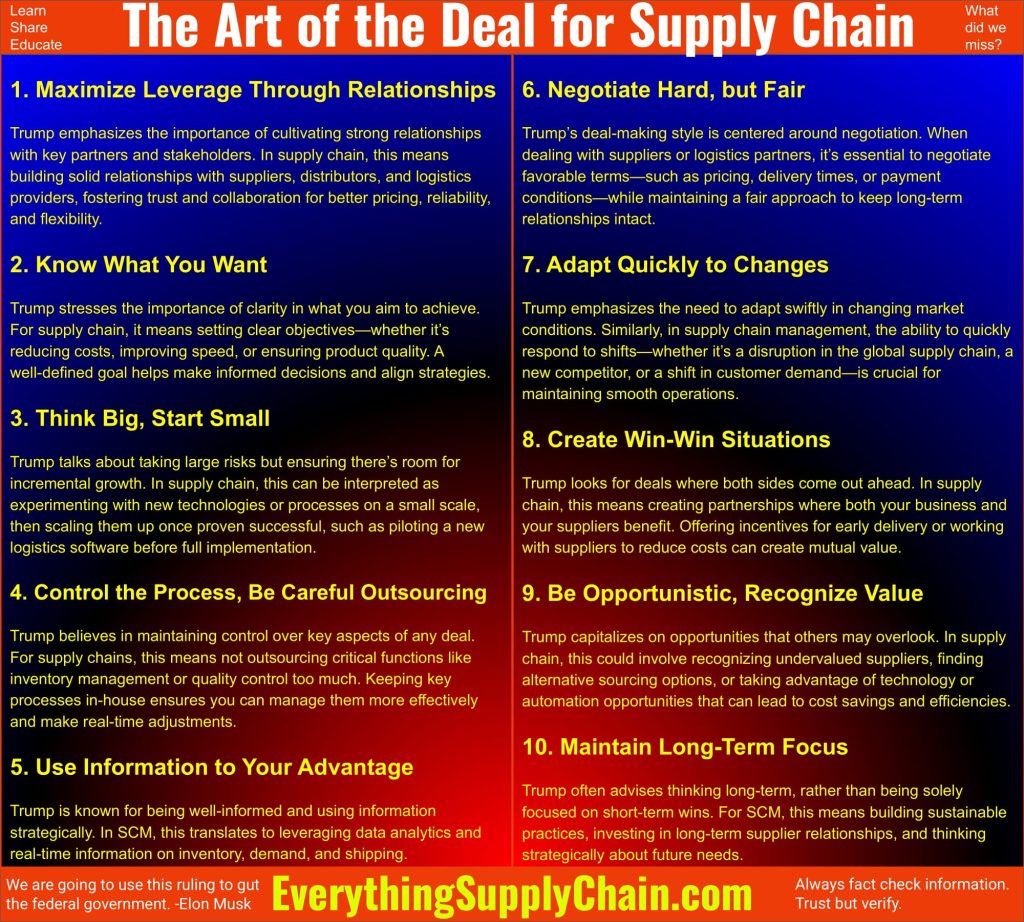

Trump’s “The Art of the Deal” applied to Supply Chain.

The H1-B Visa Debate Broken Down – Everything You Need To Know.

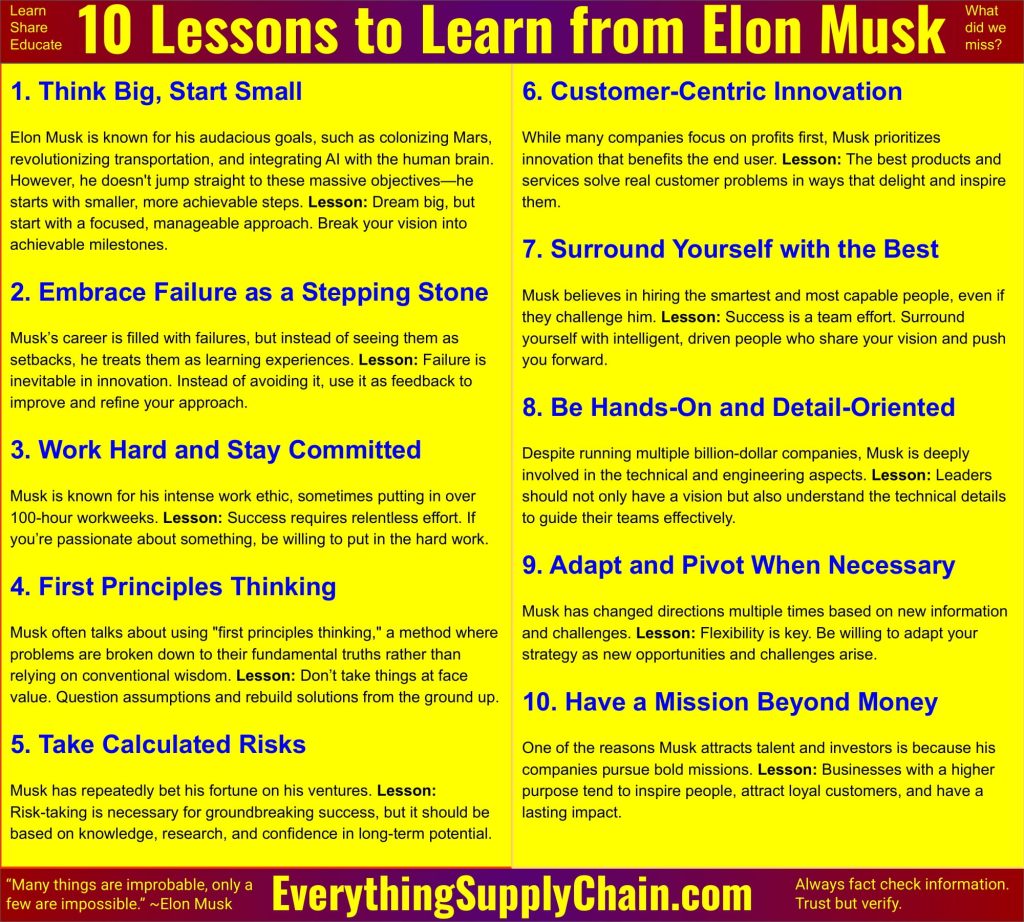

Department of Government Efficiency (DOGE): Elon Musk. Good or bad?

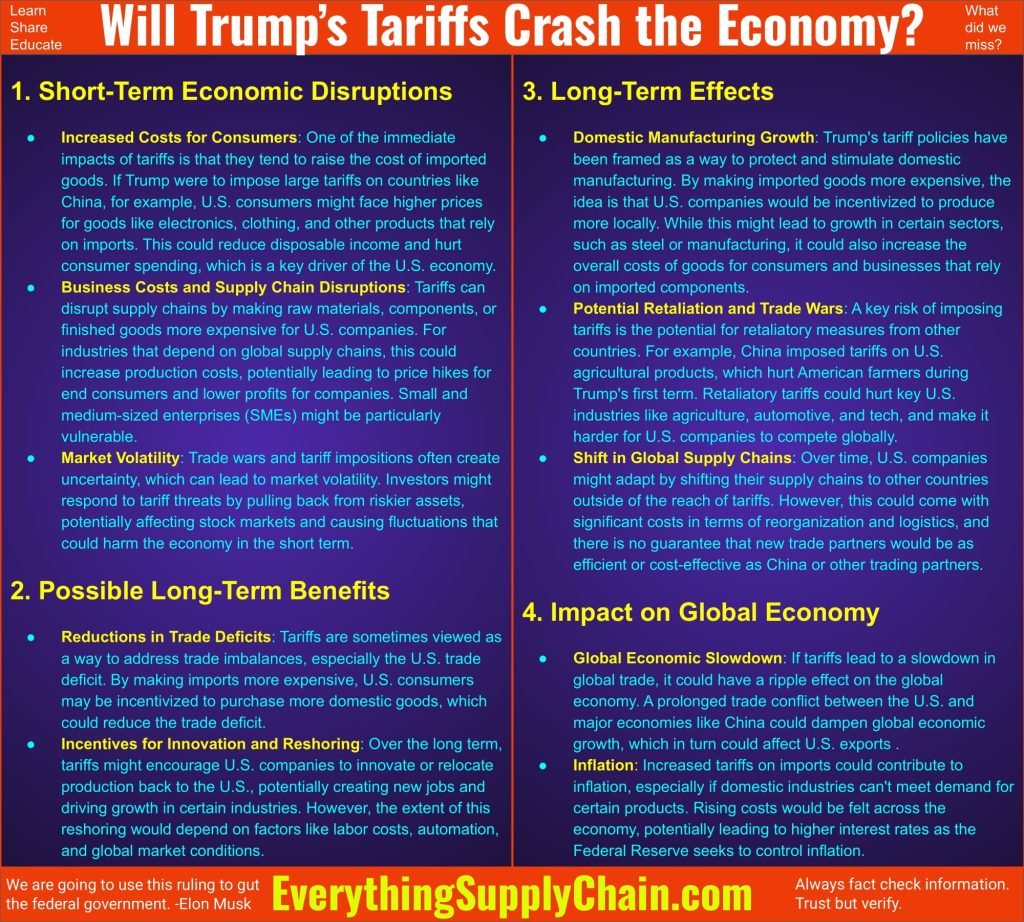

Will Trump’s Tariffs Crash the Economy?