Ways Elon Musk Might Gut the Federal Government.

There has been a great deal of discussion on how Elon Musk might gut the federal government through the Department of Government Efficiency. Cutting costs in the U.S. government is a complex challenge that requires a combination of long-term strategy, operational efficiency, and careful prioritization of resources. Below are ten potential ways the government could reduce spending while maintaining essential services.

Further Details:

1. Streamline Defense Spending

- Details: The U.S. military budget accounts for nearly one-third of total federal discretionary spending. With more than $700 billion allocated to defense each year, there’s room for reducing inefficiencies. The U.S. could reassess the need for some advanced weapons systems, bases, or missions that no longer align with current strategic priorities.

- Reducing Wasteful Projects: High-cost projects like the F-35 fighter jet program, which has faced delays and cost overruns, could be reevaluated for their actual military necessity.

- Military Infrastructure: The U.S. maintains military bases across the globe, many of which are outdated or strategically irrelevant. Closing or consolidating some overseas bases could result in significant savings.

- Personnel Overhaul: Reducing bureaucratic layers within the Department of Defense and streamlining procurement could also contribute to cost reductions.

- Potential Savings: A 10% reduction in defense spending could free up $70 billion annually. Even small efficiency gains could result in significant reductions over time.

2. Reform Healthcare Spending

- Details: Healthcare spending in the U.S. is unsustainable, comprising nearly 18% of GDP. Several key areas where the government could cut costs without reducing care quality include:

- Prescription Drug Prices: Allowing Medicare to negotiate drug prices could lead to savings. The U.S. pays more for pharmaceuticals than any other developed country, largely due to high prices set by pharmaceutical companies.

- Administrative Costs: The U.S. healthcare system is notoriously complex, with high administrative costs for both public and private insurers. Simplifying billing, standardizing health records, and using technology for better efficiency could dramatically reduce costs.

- Prevention and Public Health: Investing more in preventive care and tackling chronic conditions could reduce the need for expensive emergency treatments and long-term care, lowering overall costs.

- Potential Savings: Medicare negotiation alone could save $500 billion over the next decade. By investing in prevention, overall healthcare costs could be reduced by billions.

3. Reduce Fraud, Waste, and Abuse

- Details: The U.S. government spends significant amounts on programs like Social Security, Medicare, Medicaid, and defense contracting, and improper payments due to fraud, abuse, and errors contribute to billions in waste.

- Improved Fraud Detection: Investing in more sophisticated technology (such as AI-driven analytics) to detect and prevent fraud could identify false claims in real-time, reducing billions in waste.

- Stronger Oversight of Contractors: The Department of Defense and other agencies often award contracts that result in overcharges and fraud. Tightening contract oversight, reducing the use of sole-source contracts, and improving competitive bidding could save substantial amounts.

- Potential Savings: According to estimates, the government loses about $175 billion annually due to improper payments. With better monitoring, the government could recover a substantial percentage of this.

4. Improve Federal Tax Collection and Close Loopholes

- Details: There is significant revenue leakage in the U.S. tax system due to tax evasion and loopholes that benefit wealthy individuals and corporations.

- Crack Down on Evasion: Strengthening the IRS and improving technology for audits and enforcement could recapture billions in lost revenue. Additionally, investing in IRS staffing and technology to audit complex corporate tax structures could increase compliance rates.

- Close Tax Loopholes: Certain tax incentives and loopholes disproportionately benefit large corporations and the wealthy. Reforming corporate tax rules, such as the “carried interest loophole” or multinational tax avoidance, could generate significant revenue.

- Potential Savings: Closing tax loopholes and improving enforcement could yield an additional $500 billion over the next decade.

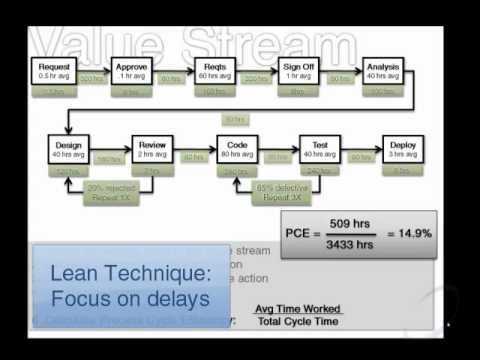

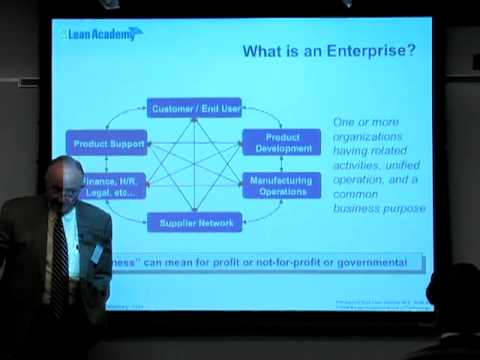

5. Consolidate and Streamline Federal Agencies

- Details: The U.S. government is made up of hundreds of agencies, many of which have overlapping missions and functions. Consolidating these agencies and reducing redundancy would eliminate inefficiencies and cut down on administrative costs.

- Department Mergers: For example, merging the Department of Education and the Department of Labor could help streamline workforce development and education programs. Similarly, merging health-related agencies like the CDC, FDA, and NIH could improve coordination and reduce duplication.

- Simplify Programs: Many government programs offer overlapping benefits that could be streamlined or combined, such as programs in housing and food assistance that have similar goals but duplicate administrative costs.

- Potential Savings: A 15-20% reduction in administrative costs could save $10-20 billion annually.

6. Shift to Digital Government Services

- Details: The U.S. government still relies heavily on paper-based systems, which are inefficient and costly. Transitioning more services to digital platforms would not only make them more accessible but would reduce administrative overhead.

- Digital Services: Services like tax filing, benefits management, and even certain court services could be fully digitized. The U.S. Digital Service (USDS) has already proven the potential of digital tools for improving government operations.

- Cloud Computing: Moving more data storage and operations to the cloud could reduce IT infrastructure costs, streamline data access, and improve cybersecurity.

- Potential Savings: By digitizing services and eliminating paper-based operations, the government could save $5-10 billion per year in administrative costs alone.

7. Reform Entitlement Programs

- Details: Programs like Social Security, Medicare, and Medicaid are essential but have seen costs rise steadily due to the aging population and rising healthcare costs.

- Social Security Reform: Adjusting benefits, such as raising the retirement age or altering the cost-of-living adjustments, could reduce future payouts.

- Medicare Reform: Shifting towards more means-testing for benefits or modifying the way healthcare providers are reimbursed could help slow down the growth of Medicare spending.

- Medicaid Efficiency: Strengthening Medicaid fraud prevention and managing state-level costs more effectively could save money.

- Potential Savings: Over time, reforms could save up to $1 trillion in the next decade, especially if eligibility and benefits are carefully adjusted to maintain long-term sustainability.

8. Cut Agricultural Subsidies

- Details: The U.S. spends billions annually on subsidies for certain crops, such as corn, wheat, and soybeans. While these subsidies were initially designed to support farmers, they disproportionately benefit large agribusinesses rather than small farmers and often encourage overproduction of commodity crops that contribute to health issues.

- Reform Subsidies: Redirecting subsidies to promote more sustainable farming practices and reduce subsidies for crops that already receive significant corporate support could be more cost-effective.

- Focus on Sustainability: Providing incentives for regenerative agriculture and practices that minimize environmental damage could reduce long-term costs associated with soil degradation and environmental health.

- Potential Savings: A reduction in commodity crop subsidies could save $10-15 billion annually.

9. Reduce Federal Employee Benefits and Pensions

- Details: Federal employees receive significant benefits, including pensions that are often more generous than those in the private sector. Shifting to a more sustainable system could reduce future liabilities.

- Transition to Defined-Contribution Plans: New federal employees could be moved to 401(k)-style plans rather than the traditional defined-benefit pension plans, which are expensive to maintain.

- Reduce Healthcare Benefits: Modifying health benefits or introducing means-testing for healthcare coverage for retirees could also help control costs.

- Potential Savings: Over the next few decades, transitioning federal pensions to more modern retirement accounts could save hundreds of billions in liabilities.

10. Negotiate Bulk Purchases and Government Contracting

- Details: The U.S. government often pays above-market rates for goods and services. By negotiating better prices and leveraging the buying power of the government, costs could be reduced across many sectors.

- Bulk Purchasing Power: Whether it’s office supplies, military equipment, or even healthcare supplies, the government could negotiate larger-scale, multi-year contracts to get better prices.

- Competitive Bidding and Transparency: Expanding the use of competitive bidding, especially in defense and technology sectors, could lower costs and ensure taxpayer dollars are spent efficiently.

- Potential Savings: Improved procurement practices could save $10-20 billion annually, particularly if more government purchases are made through bulk agreements.

Conclusion:

Each of these strategies represents a potential path for the U.S. government to significantly reduce spending without undermining the core functions of government. While each proposal requires careful planning and negotiation, especially in balancing the needs of different stakeholders, these cost-cutting measures could help ensure long-term fiscal sustainability while maintaining critical public services. As with all large-scale reforms, the key will be identifying priorities, reducing inefficiencies, and implementing changes in a way that is both politically feasible and economically effective.

Quotes on Government Spending and Gut the Government.

- “First rule in government spending: why build one when you can have two at twice the price?” ~Carl Sagan

- “The real goal should be reduced government spending, rather than balanced budgets achieved by ever rising tax rates to cover ever rising spending.” ~Thomas Sowell

- “Artificial intelligence will disrupt all industries. Don’t be left behind.” (This includes the federal government) ~Dave Waters

- “Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.” ~Ronald Reagan

- “We are going to use this ruling to gut the federal government.” ~Elon Musk

“It is a popular delusion that the government wastes vast amounts of money through inefficiency and sloth. Enormous effort and elaborate planning are required to waste this much money.” ~P. J. O’Rourke - “I would set aside all these budget cuts that are going to devastate the F.B.I., the C.I.A., and the N.S.A. Sequestration, cuts, are not only gutting the military, they’re gutting the F.B.I. So if I were president, I would set these cuts aside. I would reinstate the N.S.A. program as robust as possible within the constitutional limits.” ~Rand Paul

- “I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending, on objects of benevolence, the money of their constituents.” ~James Madison

- “Government is not a solution to our problem government is the problem.” ~Ronald Reagan

Continuous Improvement Resources

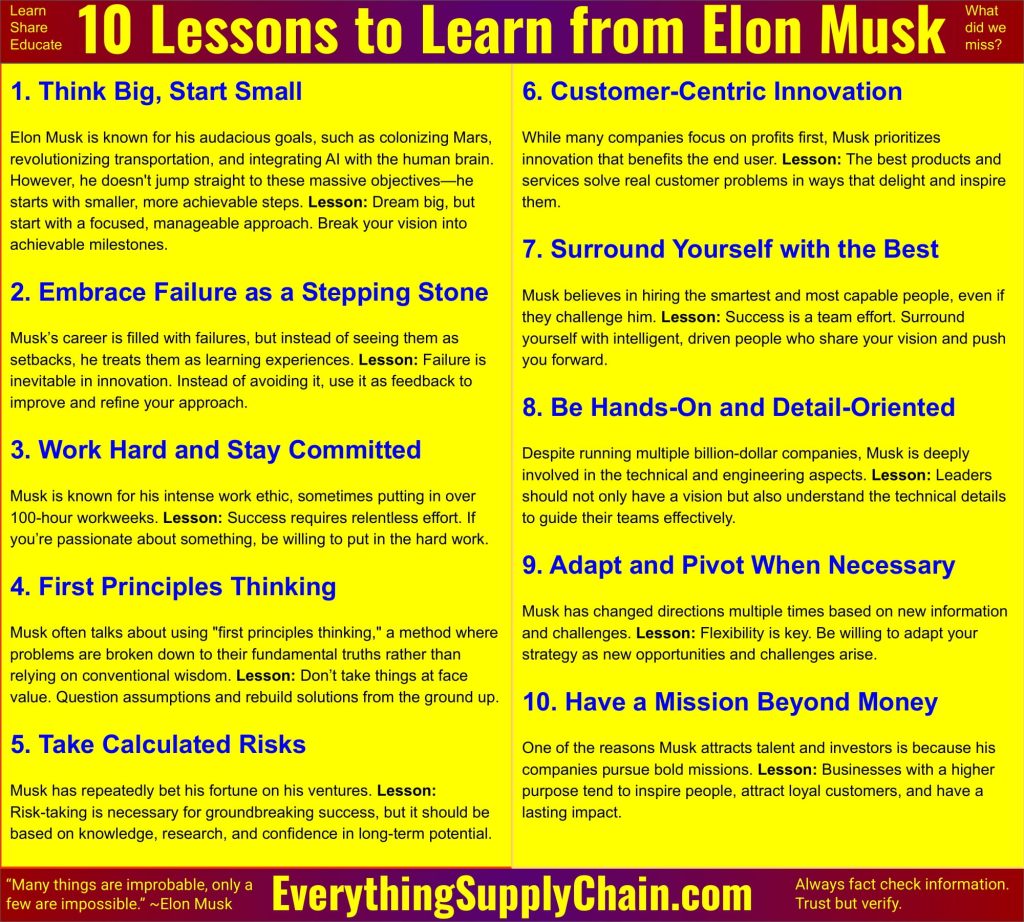

- Department of Government Efficiency (DOGE): Elon Musk. Good or bad?

- Elon Musk and First Principles Thinking.

- Elon Musk on the Improvement Process.

- First Principles: Elon Musk Method of Thinking.

- How to Eliminate Cost in the Supply Chain.

- Process Improvement Quotes and Blogs.

- Pros and Cons of Higher Tariffs. Good or Bad for the Economy?

- What to expect from Elon Musk’s Department of Government Efficiency?