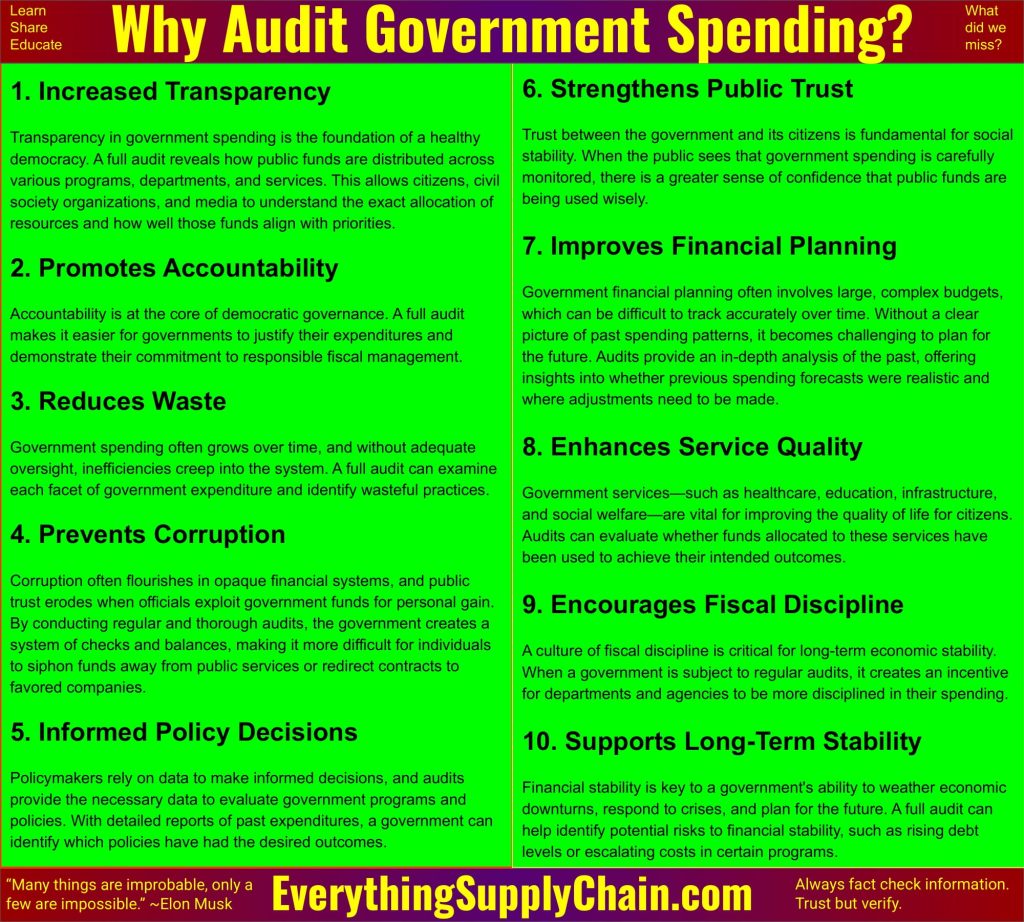

Why Audit Government Spending?

A full audit of government spending isn’t just about reviewing financial records—it’s an essential process for improving efficiency, promoting accountability, and building a government that serves the needs of its citizens effectively. It empowers governments to make smarter, data-driven decisions that enhance public services, foster trust, and ensure long-term economic stability.

Further Details:

1. Increased Transparency

Transparency in government spending is the foundation of a healthy democracy. A full audit reveals how public funds are distributed across various programs, departments, and services. This allows citizens, civil society organizations, and media to understand the exact allocation of resources and how well those funds align with the government’s stated priorities. The audit process can also reveal how different political parties or government officials handle taxpayer dollars. If discrepancies arise, they can be addressed and explained publicly, encouraging an open dialogue between the government and its citizens. Transparency also empowers voters to make informed decisions at the ballot box, knowing whether their elected representatives are following through on promises or mismanaging resources.

2. Promotes Accountability

Accountability is at the core of democratic governance. A full audit makes it easier for governments to justify their expenditures and demonstrate their commitment to responsible fiscal management. When a government is audited, each department must provide evidence of how their budgets are spent and whether they have adhered to their goals. If a government project or program fails to achieve its objectives despite receiving funding, officials can be called upon to explain why the money was wasted or misdirected. In extreme cases, those responsible for mismanagement may face legal consequences or be removed from office. Accountability in public spending is essential to ensure that elected officials prioritize the public’s welfare, not personal or political gain.

3. Reduces Waste

Government spending often grows over time, and without adequate oversight, inefficiencies can creep into the system. A full audit can examine each facet of government expenditure and identify wasteful practices. This includes duplicated efforts across multiple agencies, mismanagement of public services, or funding for outdated and redundant projects. Identifying these issues early ensures that unnecessary programs can be cut or redesigned to maximize their impact, freeing up resources for more pressing needs. For example, audits may highlight a government department that is significantly overspending on administrative costs while delivering subpar services. This insight allows for budget reallocations to more critical programs, reducing waste and increasing effectiveness.

4. Prevents Corruption

Corruption often flourishes in opaque financial systems, and public trust erodes when officials exploit government funds for personal gain. By conducting regular and thorough audits, the government creates a system of checks and balances, making it more difficult for individuals to siphon funds away from public services or redirect contracts to favored companies. Audits track the flow of money, ensuring contracts are awarded fairly and funds are spent according to established rules. When irregularities are discovered, they can be investigated, leading to possible sanctions, criminal charges, or the loss of public office. This level of scrutiny serves as a powerful deterrent to corrupt practices, helping to maintain the integrity of public institutions.

5. Informed Policy Decisions

Policymakers rely on data to make informed decisions, and audits provide the necessary data to evaluate government programs and policies. With detailed reports of past expenditures, a government can identify which policies have had the desired outcomes and which have fallen short. For example, an audit of a healthcare initiative might show that the funding was misallocated, and the program did not achieve the expected improvements in public health. Armed with this knowledge, policymakers can redirect resources to more successful programs or redesign failing policies to better serve the public. Furthermore, audits help predict future costs, enabling lawmakers to draft more realistic and sustainable budgets that account for potential challenges and long-term priorities.

6. Strengthens Public Trust

Trust between the government and its citizens is fundamental for social stability. When the public sees that government spending is carefully monitored, there is a greater sense of confidence that public funds are being used wisely. Conversely, when there is a lack of transparency or evidence of mismanagement, it leads to public disillusionment and apathy. Full audits offer assurances that the government is not only spending wisely but is also willing to address mistakes and implement corrective measures. This open approach strengthens democratic engagement, as citizens can feel more confident that their tax dollars are supporting initiatives that align with their values and interests.

7. Improves Financial Planning

Government financial planning often involves large, complex budgets, which can be difficult to track accurately over time. Without a clear picture of past spending patterns, it becomes challenging to plan for the future. Audits provide an in-depth analysis of the past, offering insights into whether previous spending forecasts were realistic and where adjustments need to be made. This data is especially valuable in times of economic uncertainty when governments must make difficult decisions about where to allocate limited resources. For instance, an audit might reveal that certain public works projects are consistently underfunded or that unexpected costs have caused budget overruns. Armed with this knowledge, governments can adjust their financial planning, prioritize the most critical needs, and allocate funds more efficiently.

8. Enhances Service Quality

Government services—such as healthcare, education, infrastructure, and social welfare—are vital for improving the quality of life for citizens. Audits can evaluate whether funds allocated to these services have been used to achieve their intended outcomes. If an audit uncovers inefficiencies or poor results in certain services, reforms can be implemented to improve their effectiveness. For example, audits may reveal that a public housing project has failed to meet the needs of residents or that a healthcare program is not reaching underserved populations. By addressing these shortcomings, governments can enhance the quality of essential services and ensure that they are meeting the needs of the public.

9. Encourages Fiscal Discipline

A culture of fiscal discipline is critical for long-term economic stability. When a government is subject to regular audits, it creates an incentive for departments and agencies to be more disciplined in their spending. Departments are more likely to stick to their budgets, as they know their financial activities will be scrutinized. This reduces the likelihood of overspending or engaging in wasteful practices. Additionally, a disciplined approach ensures that funding is used for its most critical purposes, rather than diverting resources to politically motivated projects. Fiscal discipline is particularly important during economic downturns when governments need to carefully manage their finances and prioritize essential programs.

10. Supports Long-Term Stability

Financial stability is key to a government’s ability to weather economic downturns, respond to crises, and plan for the future. A full audit can help identify potential risks to financial stability, such as rising debt levels or escalating costs in certain programs. Early identification of these risks allows governments to take preemptive measures, such as scaling back spending or exploring new revenue sources, before problems become unmanageable. For example, an audit might show that a public pension fund is running into long-term sustainability problems, signaling the need for reform. By addressing these issues early, governments can avoid the need for drastic cuts or tax hikes later, helping maintain fiscal health and ensuring stable governance over time.

Audit Government Spending Quotes

- “I believed the only thing that could turn around this government spending and mounting debt would be if the people rose up.” ~Jim DeMint

- “The goal is to reduce the size and scope of government spending, not to focus on the deficit. The deficit is the symptom of the disease.” ~Grover Norquist

- “We need transparency in government spending. We need to put each government expenditure online so every Floridian can see where their tax money is being spent.” ~Marco Rubio

- “What’s hurting the U.S. economy is total government spending. The deficit is an indicator that the government is spending so much money that it can’t even get around to stealing all of the money that it wants to spend. But the tip of the iceberg is not what hit the Titanic – it was the 90 percent of the iceberg under water.” ~Grover Norquist

- “The real goal should be reduced government spending, rather than balanced budgets achieved by ever rising tax rates to cover ever rising spending.” ~Thomas Sowell

- “After the $700 billion bailout, the trillion-dollar stimulus, and the massive budget bill with over 9,000 earmarks, many of you implored Washington to please stop spending money we don’t have. But, instead of cutting, we saw an unprecedented explosion of government spending and debt, unlike anything we have seen in the history of our country.” ~Michele Bachmann

- “Most people who are poor have their money in a bank account that earns negligible interest. With the rapid inflation that we have because of rampant government spending, the people are losing purchasing power – they’re actually becoming poorer.” ~Francis X. Suarez

Government and Supply Chain Resources

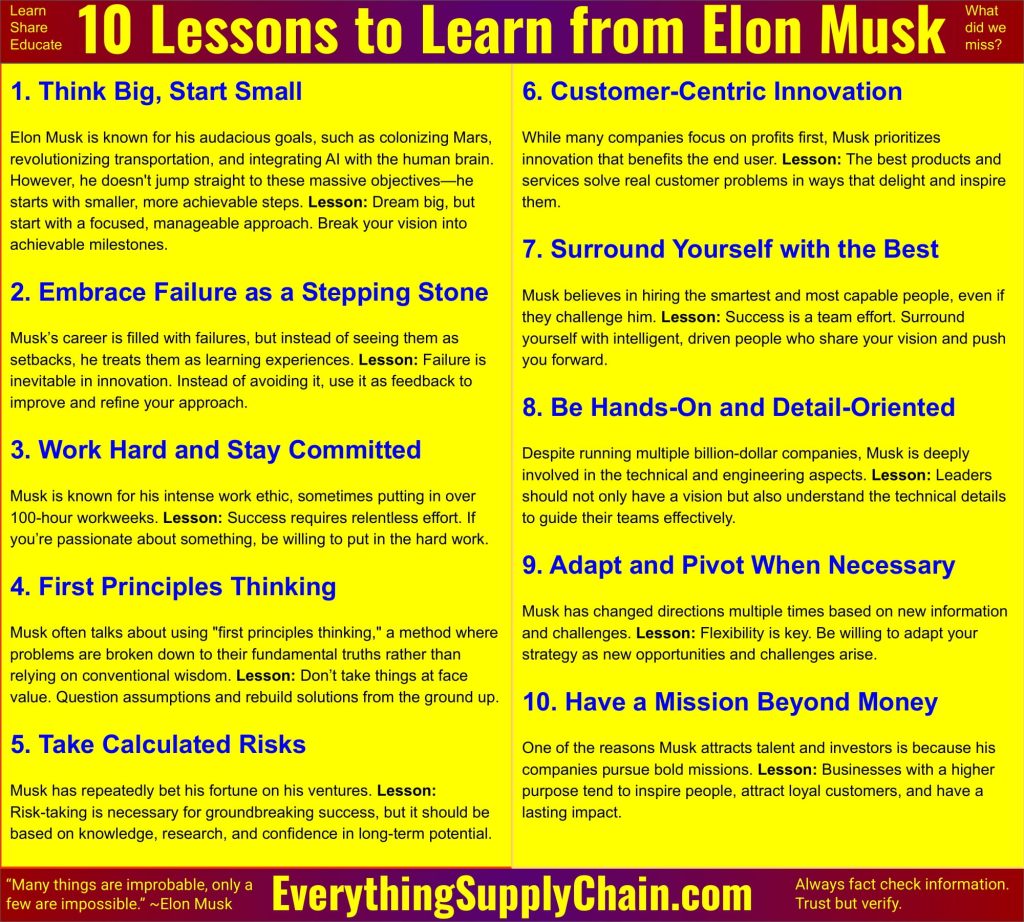

- Department of Government Efficiency (DOGE): Elon Musk. Good or bad?

- Elon Musk and First Principles Thinking.

- First Principles: Elon Musk Method of Thinking.

- How to Eliminate Cost in the Supply Chain.

- Inflation and Rising Living Costs – Supply Chain at Home.

- Trump’s “The Art of the Deal” applied to Supply Chain.

- Use AI Tools to Reduce Business Costs.

- Ways Elon Musk Might Gut the Federal Government.

- What to expect from Elon Musk’s Department of Government Efficiency?