Will Trump’s Tariffs Crash the Economy?

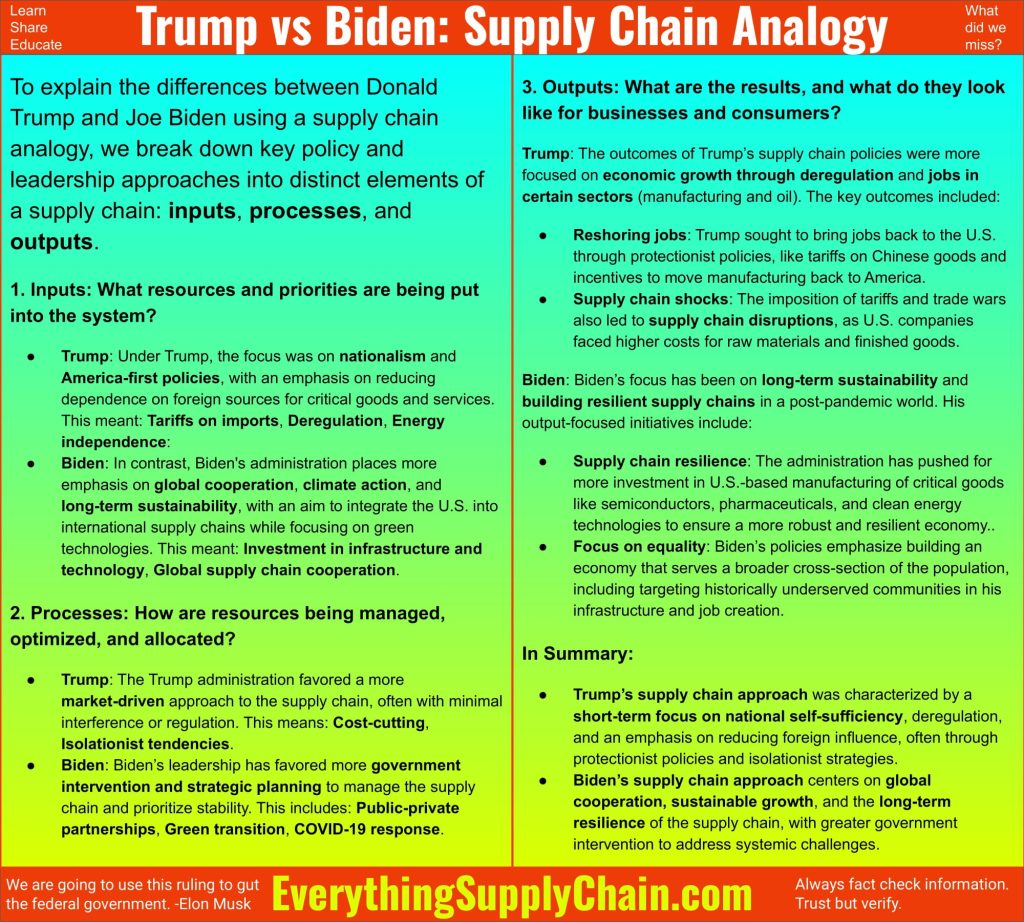

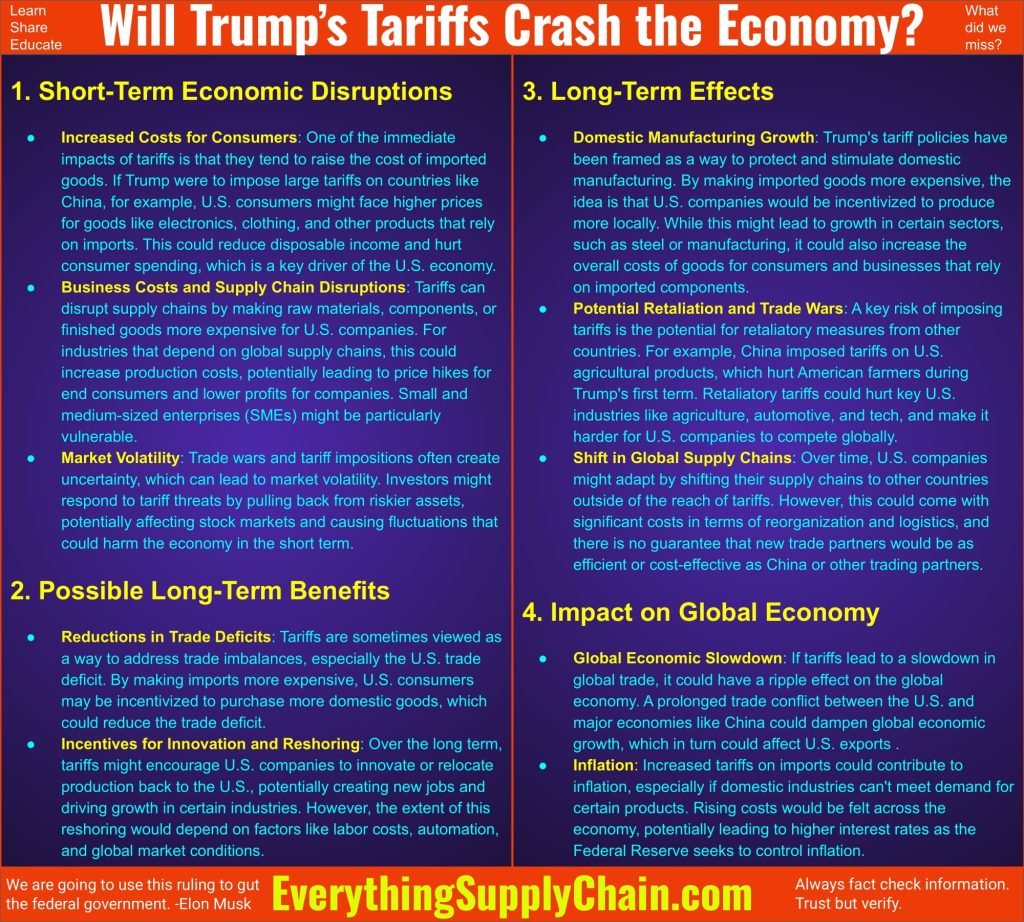

Whether Donald Trump’s tariffs would “crash” the economy is a complex question, as it depends on various factors including the scope and duration of the tariffs, the industries affected, and the response from both domestic and international markets. Here are some key points to consider:

Further Details:

1. Short-Term Economic Disruptions

a. Increased Costs for Consumers

Tariffs are essentially taxes on imported goods. When countries like the U.S. impose tariffs on imports, companies that rely on these goods for production or resale face higher costs. These higher costs are typically passed on to consumers, resulting in price increases. For example:

- Electronics: Products like smartphones, computers, and televisions, which are often manufactured in China or other low-cost regions, could become more expensive due to tariffs.

- Clothing and Footwear: Many consumer goods, including apparel and shoes, are imported from overseas, particularly from countries in Asia. Tariffs on these goods would likely raise prices for American shoppers.

Higher prices could reduce consumers’ purchasing power, leading to decreased demand for these goods. When people have to spend more on basic or desired goods, they may cut back on other discretionary spending, which can slow down overall economic activity.

b. Business Costs and Supply Chain Disruptions

- Raw Materials: Tariffs could drive up the cost of essential raw materials that U.S. manufacturers depend on. For example, steel and aluminum tariffs could hurt industries like automotive, construction, and aerospace, as these industries rely heavily on imported metals.

- Complex Supply Chains: Modern global supply chains involve intricate networks where materials or components cross multiple borders before a final product is assembled and sold. For businesses that rely on importing parts or finished goods, tariffs create uncertainties and disruptions. For instance:

- Automakers: U.S. car manufacturers that import parts from China or Mexico may face higher production costs, which could affect pricing, profitability, and even employment.

- Retailers: Large retailers like Walmart or Target, which import goods from overseas, might be forced to absorb higher costs or raise prices, reducing their profit margins.

- Time Delays: Tariffs may cause delays in the flow of goods. Businesses may need to find new suppliers or adapt their logistics, which can be time-consuming and costly.

c. Market Volatility

- Investor Sentiment: Tariffs, particularly when accompanied by trade wars or tit-for-tat retaliatory actions, create a sense of uncertainty. Investors often dislike uncertainty because it makes predicting future profits and market conditions more difficult. This can lead to stock market declines or more cautious behavior in financial markets.

- Impact on Financial Markets: For example, during Trump’s trade war with China, both stock prices and the value of the dollar fluctuated as companies and investors adjusted to the potential impacts of tariffs. A prolonged period of uncertainty could contribute to more significant market volatility, with negative effects on pension funds, investments, and individual wealth.

2. Long-Term Effects

a. Domestic Manufacturing Growth

One of the key goals of Trump’s tariffs was to incentivize the return of manufacturing jobs to the U.S. The theory is that by making imports more expensive, U.S. companies would have a greater incentive to produce goods domestically. This could benefit industries such as:

- Steel and Aluminum Production: Tariffs on foreign steel and aluminum were intended to protect and boost domestic production, which could potentially reduce reliance on imports in critical sectors like construction, defense, and infrastructure.

- Automotive and Tech: Some manufacturing could be reshored if U.S. companies view it as more cost-effective to produce at home than pay tariffs on imported goods.

However, reshoring production involves substantial investments in labor, infrastructure, and technology. Many industries, especially those that rely on low-cost labor overseas, may not find it financially viable to bring production back to the U.S. This could lead to slower progress in reshoring and less immediate economic benefit than initially anticipated.

b. Potential Retaliation and Trade Wars

One of the significant risks of imposing tariffs is the possibility of retaliation by other countries. Other economies could impose tariffs on U.S. goods in response, which would hurt U.S. exports. This “trade war” dynamic could lead to negative outcomes for sectors like:

- Agriculture: In 2018, China retaliated against U.S. tariffs by imposing tariffs on U.S. agricultural exports, including soybeans, pork, and other farm products. This caused a significant downturn in agricultural markets, and many farmers faced financial strain as a result.

- Technology: The U.S. tech industry, which depends on Chinese and global markets, could face restrictions or retaliatory tariffs on products like semiconductors or consumer electronics.

These retaliatory tariffs can diminish the competitiveness of U.S. exports in global markets and reduce American companies’ ability to access key foreign markets.

c. Global Economic Slowdown

- Disruption of Global Trade: As the U.S. is a major player in the global economy, tariffs and trade wars can disrupt the flow of goods between nations. This has a ripple effect. For instance, if the U.S. and China are in a trade war, countries that rely on trade with both the U.S. and China could see their economies negatively affected. Disruptions to the supply chains of global companies could further lead to economic slowdowns or even recessions in other countries.

- Impact on Global GDP: Some studies have shown that global GDP growth could be negatively impacted by significant trade conflicts. This would result in lower global demand for U.S. goods and services, and a reduction in U.S. exports, which further exacerbates economic contraction.

d. Inflation

- Rising Consumer Prices: Higher tariffs on imports could contribute to inflation, which occurs when the prices of goods and services increase across the economy. If raw materials, parts, and products become more expensive due to tariffs, businesses would likely raise the prices of finished goods. Inflation erodes purchasing power, meaning that consumers would be able to buy less with the same amount of money. This could lead to slower economic growth and potentially even stagflation (a combination of stagnant growth and high inflation).

- Monetary Policy: If inflation rises significantly as a result of tariffs, the Federal Reserve might increase interest rates to cool down the economy. Higher interest rates could make borrowing more expensive for businesses and consumers, further slowing economic activity.

3. Possible Long-Term Benefits

a. Trade Deficit Reduction

One of Trump’s main arguments for imposing tariffs was that it would reduce the U.S. trade deficit, or the difference between what the U.S. imports and exports. By making foreign goods more expensive, U.S. consumers might shift their spending towards domestic products, thus reducing the demand for imports.

However, achieving a meaningful reduction in the trade deficit through tariffs is challenging. The U.S. imports far more than it exports, so unless domestic production can ramp up significantly to replace imports, the deficit may not shrink substantially. Additionally, foreign retaliation could reduce U.S. exports and worsen the situation.

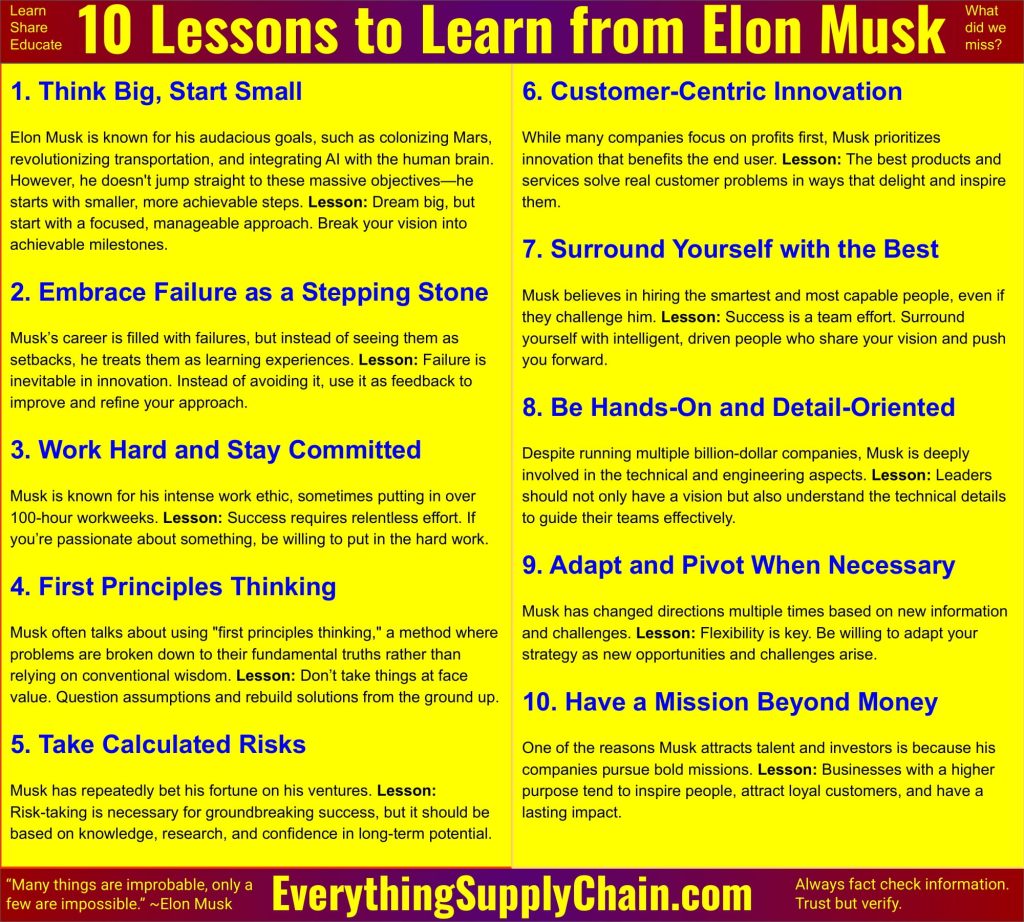

b. Innovation and Investment in Automation

Tariffs could also spur innovation as U.S. companies seek to offset rising production costs. For example, industries facing higher labor costs due to tariffs could accelerate investments in automation and technology, streamlining production and improving efficiency. This shift could create new opportunities in high-tech fields, potentially leading to long-term productivity growth and more competitive industries.

Conclusion: Will Tariffs Crash the Economy?

While Trump’s tariff policies are unlikely to “crash” the economy outright, they certainly carry risks that could lead to economic slowdown, rising costs, and market volatility. The overall impact of tariffs would depend on several factors:

- Extent and Duration: If tariffs are short-lived and limited in scope, their economic effects might be manageable. But prolonged trade wars and escalating tariffs could disrupt the economy more significantly.

- Response from Businesses: Businesses may adapt by shifting supply chains, increasing automation, or finding ways to mitigate cost increases, which could lessen the negative impacts.

- Retaliation and Global Effects: A trade war with major economies could drag down not only the U.S. economy but also the global economy, leading to job losses, slower growth, and inflation.

In conclusion, while tariffs may offer some short-term protection to specific industries, the broader economy could suffer in the long run unless carefully managed. The U.S. economy has significant resilience, but sustained trade disruptions could slow growth and create broader economic challenges.

Trade and Tariff Quotes

- “As an economist specializing in the global economy, international trade and debt, I have spent most of my career helping others make big decisions – prime ministers, presidents and chief executives – and so I’m all too aware of the risks and dangers of poor choices in the public as well as the private sphere.” ~Noreena Hertz

- “The real goal should be reduced government spending, rather than balanced budgets achieved by ever rising tax rates to cover ever rising spending.” ~Thomas Sowell

- “Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.” ~Ronald Reagan

- “In a global economy where our economies and supply chains are deeply integrated, it’s not even possible.” ~Barack Obama

- “When it comes to China, there are genuine giants that need to be conquered and dragons to tame. Protecting intellectual property rights and leveling the playing field for international trade are serious matters that must be resolved. But that will happen through honest negotiation.” ~Neil Bush

- “Each generation goes further than the generation preceding it because it stands on the shoulders of that generation. You will have opportunities beyond anything we’ve ever known.” ~Ronald Reagan

- “A president’s hardest task is not to do what is right, but to know what is right.” ~ Lyndon Johnson

Government and Tariff Resources

- 10 Strategies to Mitigate Tariffs.

- “Ask not what your country can do for you…” President Kennedy’s Speech.

- Best Trade War and Tariff Quotes.

- Department of Government Efficiency (DOGE): Elon Musk. Good or bad?

- First Principles: Elon Musk Method of Thinking.

- How Tariffs Impact Supply Chain.

- Mr. Gorbachev, tear down this wall! President Ronald Reagan

- President Quotes about Leadership

- Pros and Cons of Higher Tariffs. Good or Bad for the Economy?

- Supply Chain Strategies to Mitigate Tariff Risks.

- The H1-B Visa Debate Broken Down – Everything You Need To Know.